The latest federal budget from the Liberal government includes billions of dollars in new spending for big-ticket programs — much of which is expected to be paid for by increased taxes for the wealthy and higher taxes on tobacco products.

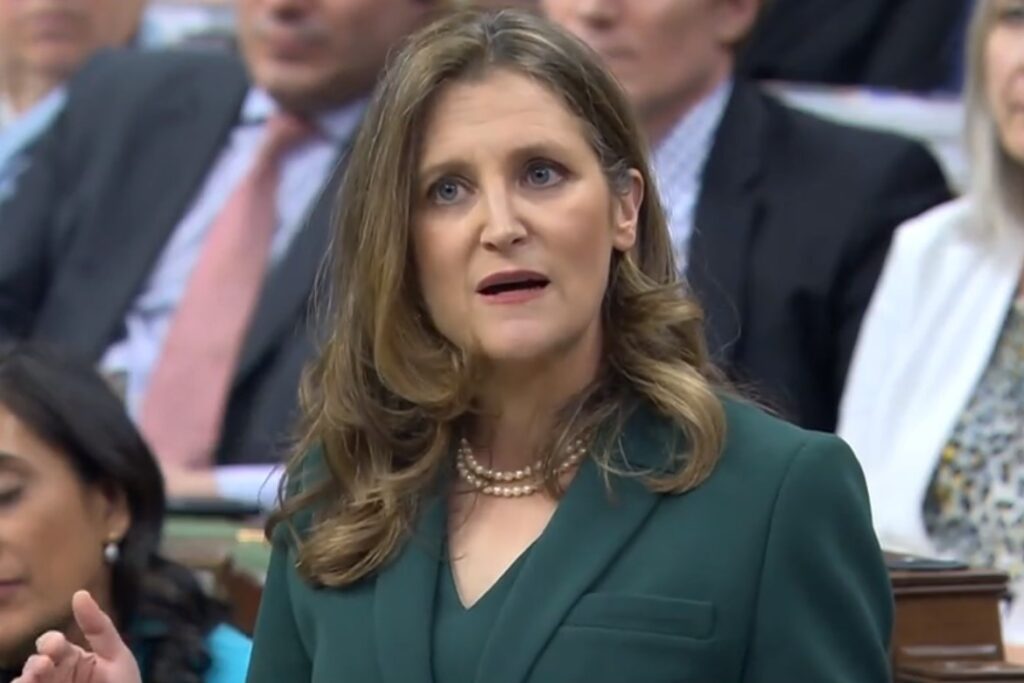

Finance Minister Chrystia Freeland’s budget for 2024 was unveiled on Tuesday and includes around $52.9 billion in new spending over the next five years.

This includes approximately $8.5 billion in new spending for housing, a $6 billion Canada Disability Benefit, and a $1 billion national school food program. The federal government is also promising to top up the incentives for zero-emission vehicles, deliver a new carbon tax rebate for small businesses, and increase student grants.

The budget details several policy changes that are expected to offset the planned spending and generate about $21.9 billion in new revenue over the next five years.

This includes higher capital gains taxes for the rich and corporations, impacting Canadians with an average annual income of around $1.4 million. The government also plans to increase excise taxes on cigarettes and vaping products.

The projected deficit for the 2024-25 fiscal year is approximately $40 billion.