Assessments and assessment growth and how they relate to how much people pay in municipal taxes was a key topic at Chatham-Kent’s live online draft budget presentation and public engagement session yesterday on their Facebook page.

With real estate prices going up significantly in the past few years in Chatham-Kent, taxpayers are nervous that they will see huge increases when the next home assessments are completed in the next couple of years.

The Municipal Property Assessment Corporation does the value assessment for more than five million properties in Ontario. Properties are normally reassessed every four years, but because of the COVID-19 pandemic, the province hasn’t completed an assessment since 2016.

With seven-plus years between assessments, there’s a fear that people with homes that have spiked in value in a hot housing market are going to be paying dramatically more in taxes than before.

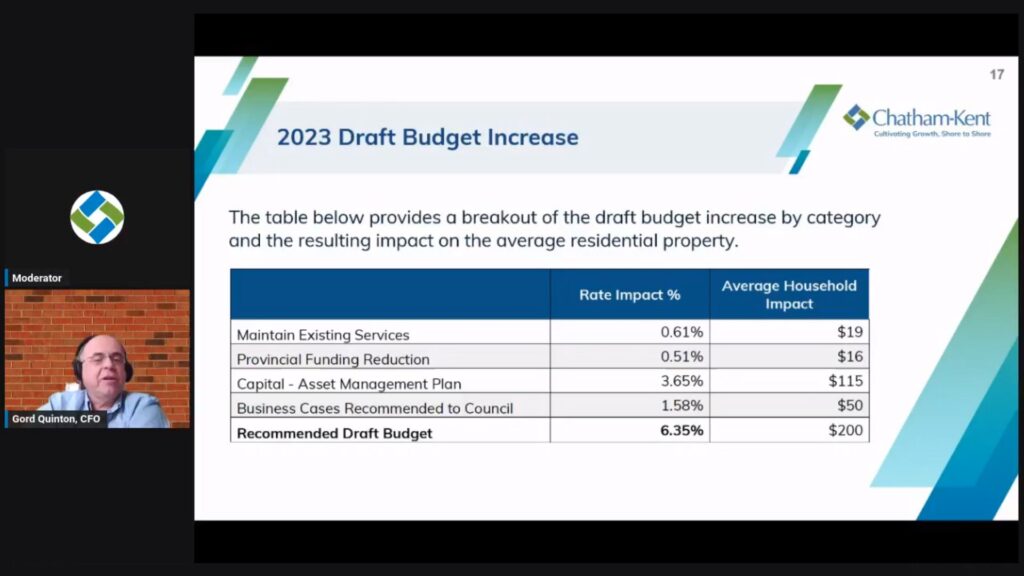

Chatham-Kent’s chief financial officer Gord Quinton addressed the issue during a Facebook live draft budget engagement session held yesterday.

Quinton said it might be until 2025 or even 2026 when the new assessments are completed.

“We are working off really old values. Some people, I would say, are paying way too much right now and some people are paying way too little right now,” Quinton said.

Quinton said if a house has gone up in value more than average compared to other households in Chatham-Kent it’s likely they will pay more in taxes when the new assessments come out, and vice versa.

A final public consultation is being held tonight, again on the Municipality of Chatham-Kent Facebook page, starting at 7pm. A video of Wednesday’s session is also still available.

Budget committee deliberations begin January 25th.