The province is launching a so-called ‘infrastructure bank’ to help inspire community development.

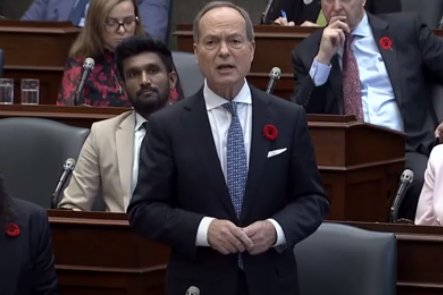

The 3-billion dollar initiative was part of Thursday’s fall economic statement, delivered at Queens Park by finance minister Peter Bethelfalvy.

The arms-length board-governed agency will enable to enable public-sector pension plans and other trusted institutional investors to participate in large-scale infrastructure projects across the province. At the outset, projects will be focused on long-term care homes, affordable housing and infrastructure in the municipal, community, energy and transportation sectors.

The government is forecasting larger than expected deficits, 5.6 billion for 2023-24, significantly higher than the 1.3 billion deficit forecast in last spring’s budget. A deficit of $5.3 billion is forecast in 2024–25, followed by a surplus of $0.5 billion in 2025–26.

Bethlenfalvy says the numbers reflect updated economic revenue information and higher contingencies, and also blamed high inflation and interest rate increases.

Other initiatives laid out in the economic update include removing the full eight per cent provincial portion of the Harmonized Sales Tax (HST) on qualifying new purpose-built rental housing, and providing an additional $100 million to the Invest Ontario Fund, for a total of $500 million, to help attract more leading companies to the province, further support businesses already here and create good-paying jobs in communities across the province.

The province has also pledged to expand breast cancer screening for women ages 40 to 49, by allowing them to self-refer for a mammogram through the Ontario Breast Screening Program. Beginning in fall 2024, these measures will increase access for more than 305,000 additional individuals.